Herewith the SARS press release announcing the Provisional Taxpayers eFiling Deadline Extended to 15 February 2021.

“Pretoria, Thursday 28 January 2021 – The South African Revenue Service (SARS) has noted with deep concern the unprecedented health challenge manifested through COVID-19 with the accompanying loss of lives and livelihoods. SARS wishes to convey its sincere and deepest condolences to those that have lost their loved ones and wish a speedy recovery to those who are convalescing at home or in hospital.

In light of these challenges, SARS has decided to extend the Filing Season deadline for provisional taxpayers, which is currently set for 29 January 2021, to 15 February 2021.

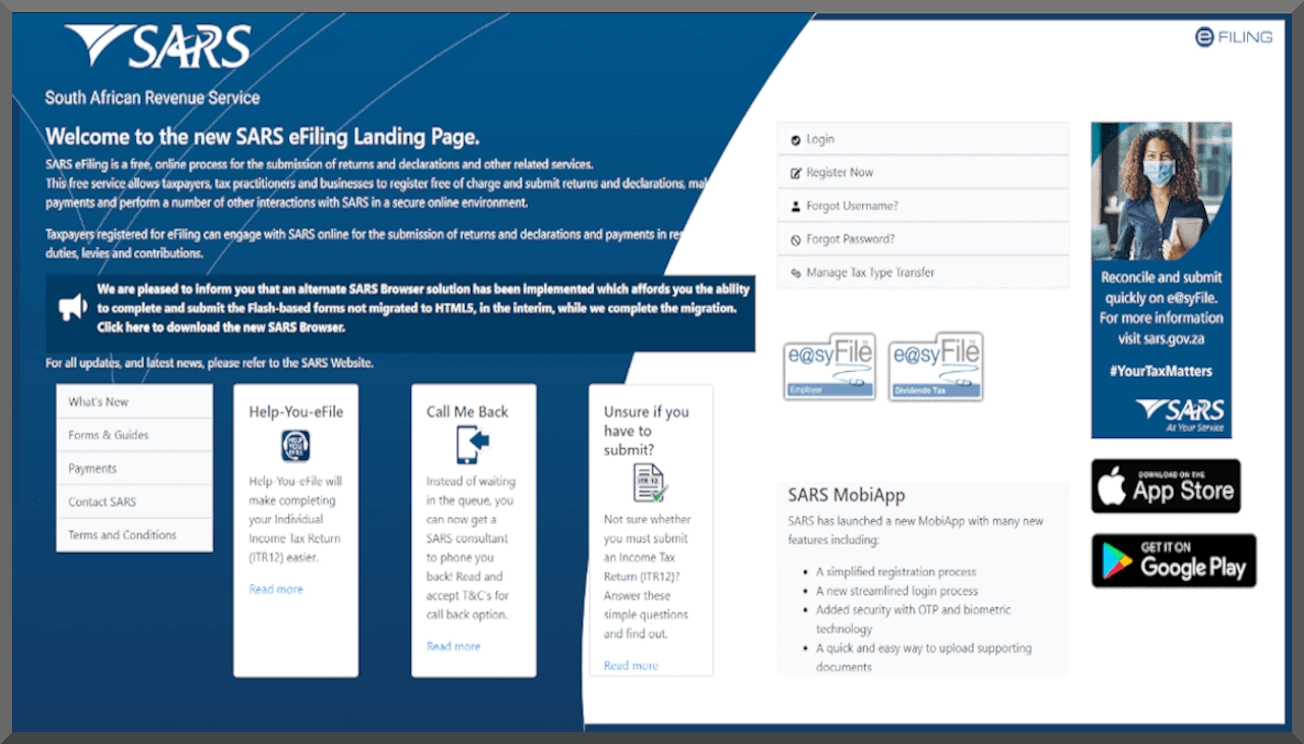

In line with SARS’ communication on steps taken to prevent the spread of COVID19 and protect both the taxpayers and SARS staff, taxpayers are encouraged to use eFiling or the SARS MobiApp.

SARS Commissioner Edward Kieswetter said, “The decision to extend the Filing Season, was taken with due consideration of the traumatic effects being experienced by taxpayers who have lost loved ones, as well as businesses who have lost staff, during the devastating second wave of Covid-19.

The Commissioner also urges taxpayers who received auto-assessment notices last year but who have not yet accepted the auto-assessments, or edited and filed a return in response to the notice, to make use of this opportunity to do so.

The Commissioner urged all these taxpayers to comply with their legal obligations by 15 February 2021, as all taxpayers must remain compliant. Failure to comply with their legal obligations will result in administrative penalties being levied.

He added that SARS has a legislative mandate to collect revenue due and to ensure compliance across all segments of taxpayers, as well as traders in the Customs arena.

“While SARS believes that most taxpayers and traders comply voluntarily and want to do the right thing, we also have measures we can use to enforce compliance. However, such enforcement always remains the last resort,” the Commissioner added.”

SARS Media release 28 January 2021.

Contact Onestop Accounting if you need any assistance with eFiling of your provisional taxes before the Filing Season deadline for provisional taxpayers on 15 February 2021.